Financial markets went on a fairly wild ride last week as downbeat manufacturing data combined…

Lowest Rates in a Year, And They Could Go Even Lower. What Changed?

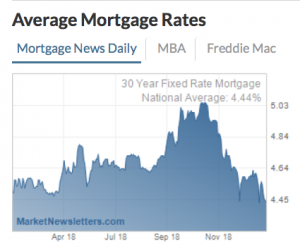

The last 2 months of 2018 marked a solid run for mortgage rates. December was particularly good, with rates falling at the fastest pace in at least at least 4 years. Balance that against the fact that early November saw the highest rates in more than 7 years!

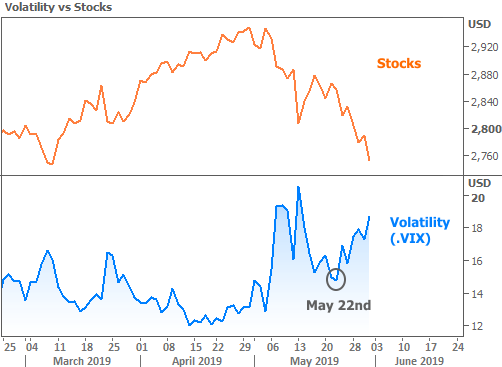

It’s not uncommon to see rates fall more quickly after hitting long-term highs. This drop was fast enough and seemingly dependent enough on stock market weakness that it made sense to worry about a snap back to higher levels in 2019.

So far, we haven’t seen any serious attempts for rates to snap back, even though stocks have recovered much of their late-2018 losses. In fact, for the first time since November 2016, we’re able to say rates are lower than they were a year ago!

Concern over a potential bounce has largely been replaced with the understanding that rates could go even lower! What changed?

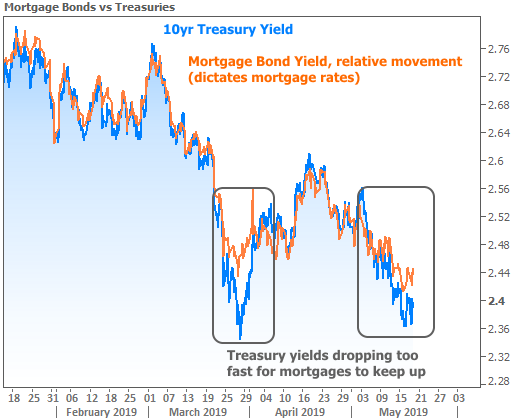

The two biggest arguments for a shift came courtesy of the world’s two biggest central banks. Two weeks ago, the European Central Bank (ECB) expressed more concern over the economic outlook than investors were expecting. Such concern tends to be good for rates.

Then last week, the Federal Reserve made a similar move. At the time, I labeled it as “utterly defying expectations” and a “sea-change in the Fed’s fairly aggressive approach.”

Bottom line: the Fed and the ECB were surprisingly friendlytoward markets, and both were citing concerns about future economic growth. This was a major departure for the Fed which, as of December, still expected several more rate hikes and no need to change its bond-buying policies.

While some would say this friendly shift was overdue, many would argue it was an over-correction at first glance. This led to credibility questions. Was the Fed caving in to Trump’s criticisms or caring too much about the stock market weakness?

The Fed maintained that its shift was driven in large part by global growth concerns, but they promptly had egg on their face. A day and a half after their announcement, all 4 economic reports (including the big jobs report) came out stronger than expected.

Strong economic data coincides with higher rates and the sort of more restrictive monetary policy that the Fed had just mysteriously abandoned. Rates moved higher into the new week and led some to question if the Fed had gone crazy.

But the Fed’s sanity was vetted this week. Global growth concerns indeed came to center stage after the EU slashed GDP forecasts to 1.3% for 2019 (previously 1.9% just 2 months ago). Germany, the largest EU economy by far, had its forecast cut from 1.8% to 1.1%.

These are big adjustments! Maybe the Fed wasn’t so crazy after all, but just a bit ahead of its time?

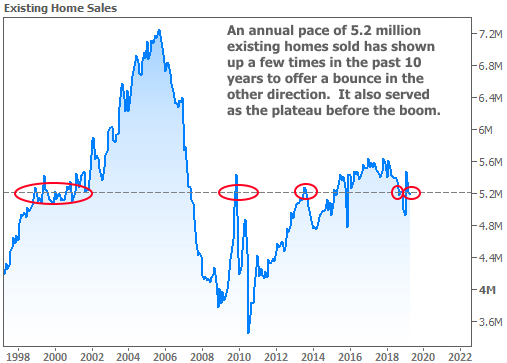

Simply put, if Europe slows down as much as expected, we likely saw the highest rates of this economic cycle in late 2018. Beyond that, if a slew of other global economic uncertainties were to walk a similarly downbeat path (slower growth in China, US/China trade deal, permanent government funding deal, Brexit negotiations, etc.), rates would have no qualms about moving even lower from here.

All of the above is still up in the air, of course, so the default approach isn’t really any different from a market-watching standpoint. Like the Fed, we’ll be paying attention to the economic data at home and abroad, as well as the more important fiscal developments. But how will the Fed interpret and adapt to the incoming data? Their next big announcement is in mid-March. Unless the global economic outlook gets gloomy enough before then, that’s when we’d expect to see an even bigger shift in the interest rate outlook.

A quick note… There is a decidedly rate-friendly tone in this week’s newsletter. This is due to an objective shift in the data and in market trading levels. As always, traders are aware of everything you just read and can move money accordingly. There is always a risk that rates can move higher or lower. The goal here was to address last week’s questioning of the Fed’s sanity. Optimism or pessimism should depend on how the economic data and fiscal developments unfold.

© 2019 MBS Live, Inc. 19701 Bethel Church Rd Suite 103-225 – Cornelius, NC 28031. All rights reserved.