Financial markets went on a fairly wild ride last week as downbeat manufacturing data combined…

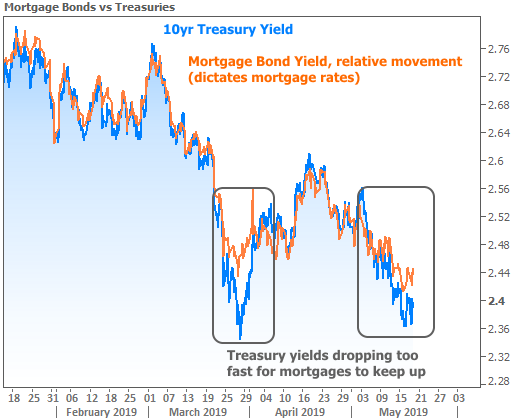

Why Aren’t Mortgages Falling as Fast as Other Rates?

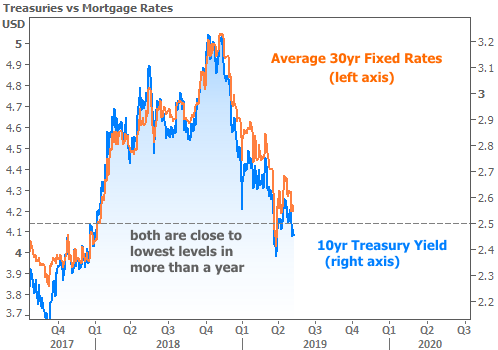

10yr Treasury yields are widely thought to dictate mortgage rate movement. This week’s trade war headlines caused plenty of volatility and a general decline in Treasury yields, but mortgage rates had a hard time keeping up.

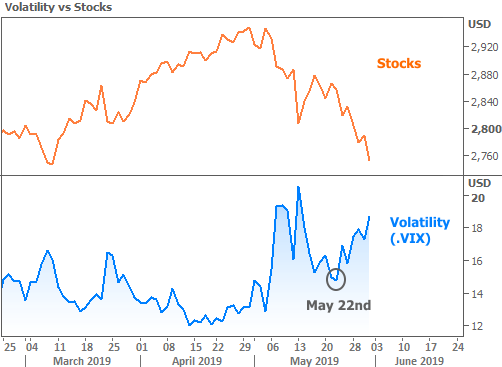

Before we get to the finer points of Treasuries vs mortgage rates, let’s recap this week’s reaction to various trade-related headlines. There’s no question that volatility increased in a major way, as can be seen in VIX chart below.

The big spike right out of the gate suggests that markets were reacting to news that hit over the weekend. Indeed, the culprit was a set of Trump tweets about raising tariff’s on Chinese goods. Combined with a story from the Wall Street Journal suggesting China was considering “pulling out of trade talks,” the message to markets was clear: something had gone wrong in the trade negotiation process.

Generally speaking, a trade deal between the US and China is almost universally viewed as good for global financial markets as well as the economies of both countries. Economic strength tends to coincide with higher stock prices and bond yields. As such, it was no surprise to see stocks and bond yields fall as trading began for the week.

From there on out, markets were transfixed by trade war drama. Here’s a quick recap of the highlights and the corresponding logical impact on stocks/bonds (“bonds” = “bond yields” in this list).

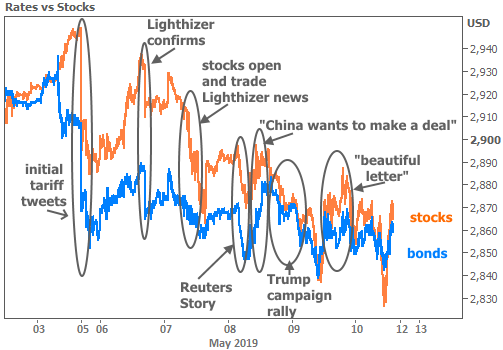

- Initial tariff tweets cause immediate drop in stocks/bonds, but markets bounce back amid an absence of additional news for most of the day on Monday.

- Monday, close of business. US Trade official Lighthizer: China has backed away from agreements. This caused another move lower in stocks/bonds, both on Monday afternoon and again when markets opened on Tuesday

- Early Wednesday morning, Reuters exclusive detailed how China had “backtracked on almost all aspects of trade deal.” Stocks/bonds fall again

- Mid-morning, White House reports that China is sending a delegation and “wants to make a deal.” Stocks and bonds move back up briefly

- Wednesday evening, at a campaign rally, Trump says China “broke the deal. They can’t do that, so they’ll be paying.”

- Thursday mid-day, Trump says he received a “beautiful letter” from President Xi, and cites Xi as saying “let’s work together to see if we can get something done.” Stocks and bonds bounce.

- Finally, stocks and bonds fall back in line with lows as trade talks conclude for the week, only to bounce back up to the day’s highs following positive comments from Trump in the afternoon (not highlighted below)

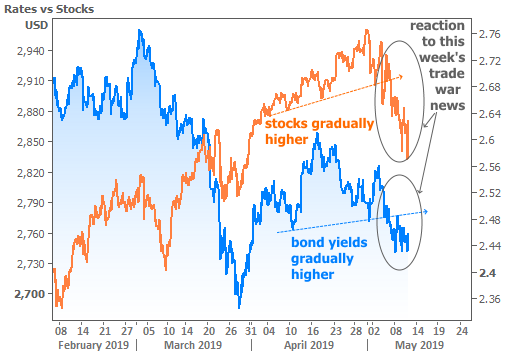

Before this fairly wild week, it looked like rates had decided to move higher after being unable to break below key levels last week due to Fed Chair Powell’s press conference on Wednesday. Stocks didn’t love what they heard from Powell but were nonetheless able to hold near all-time highs.

Powell aside, stocks and bonds were both moving gradually higher anyway. Viewed in the bigger picture, this week’s trading resulted in a fairly obvious reversal of those trends.

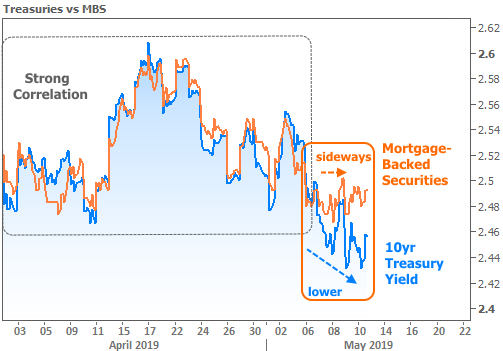

To come back to our original thesis, although we are certainly seeing a general decline in Treasury yields this week, mortgage rates are just as certainly having a hard time keeping up. This will be especially puzzling to anyone laboring under the misapprehension that Treasury yields always dictate mortgage rates.

While it is very true that Treasuries represent the benchmark/core of the US interest rate market, and also very true that mortgages tend to correlate almost perfectly with Treasury movement, there are notable exceptions. Mortgages are actually driven directly by mortgage-backed securities (MBS). Simply put, these are bonds composed of groups of mortgages for the purpose of managing risk and providing liquidity among mortgage investors.

Because the government took control of the two biggest issuers of MBS during The Financial Crisis, MBS returns are just as guaranteed as Treasury returns. If that were the only thing investors cared about, MBS would always move in lock-step with Treasuries.

But MBS are subject to a huge variable that Treasuries never have to worry about: human behavior. Whereas the government will pay the agreed-upon yield on a Treasury security as long as it lasts, a mortgage borrower will only pay the agreed-upon yield (aka “interest”) as long as they have their mortgage. For a variety of reasons, they may decide to move or refinance. When that happens, the investor is no longer receiving the stream of payments with interest that it signed up for.

The early retirement of a mortgage is referred to as “prepayment” in the secondary market, and it goes hand in hand with another MBS buzz word: “speeds.” This simply refers to the speed at which certain vintages of MBS are being paid off.

To make a long story short, the monthly prepayment report showed a drastic increase in speeds early this week. This suggested MBS were a bit overvalued relative to Treasuries, and a logical correction ensued (even though it seemed paradoxical on the surface).

The good news is twofold. First, the correction is over for now and in fact, mortgages outperformed Treasuries on Friday. But more importantly, this was only ever cause for concern when looking at rate movement under a microscope. Both mortgage rates and Treasury yields are operating very close to the lowest levels in more than a year.

The week ahead should be telling for markets as traders are able to get back to business following this week’s trade war diversions. Economic data will return after being mostly absent or inconsequential this week. In that regard, next Wednesday’s Retail Sales report is likely the most important data point followed by a smattering of other mid-tier reports in the 2nd half of the week.

Sign up for the newsletter here:

http://housingnewsletters.com/marketupdates/Subscribe

© 2019 MBS Live, Inc. 19701 Bethel Church Rd Suite 103-225 – Cornelius, NC 28031. All rights reserved.