Financial markets went on a fairly wild ride last week as downbeat manufacturing data combined…

The Fed Will Hike, But Rates Could Keep Falling

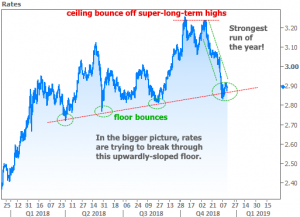

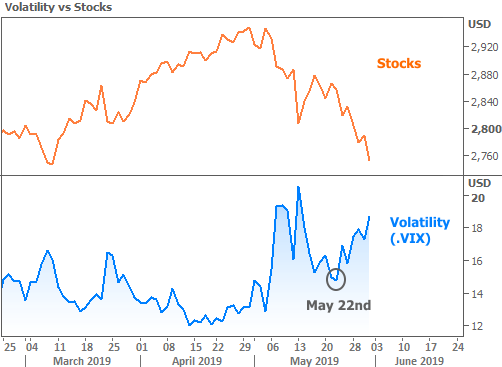

Last week, we discussed a surprising spike in market volatility. Fortunately, one of the volatile moves involved interest rates dropping to their lowest levels since September. This week has been quite different. The volatility is gone. Rates have bounced modestly and consolidated (i.e. moved in a narrower range).

Consolidation is often seen just ahead of some big flashpoint. While there are a few potential market movers in play right now, the biggest potential flashpoint would be next week’s policy announcement from the Fed. Not only is it likely to inform the direction of the next “strong move,” but it may well cast a vote on rates being able to break below this longer-term floor.

If we’re talking about the Fed being the deciding factor in rate momentum, and if we know that the Fed is in charge of hiking or cutting interest rates, you’d be well within your rights to assume that a Fed rate hike is tantamount to a vote for another “floor bounce” as seen in the chart above. But that’s not exactly how it works.

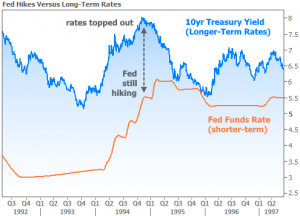

In fact, the Fed could hike next week and rates could keep on falling. That seems confusing at first glance, but consider that there are many different types of interest rates (fixed, variable, long-term, short-term, etc). The Fed Funds Rate (the thing the Fed hikes or cuts) is the shortest-term rate (it only applies to the money big banks need to borrow from each other to meet overnight obligations).

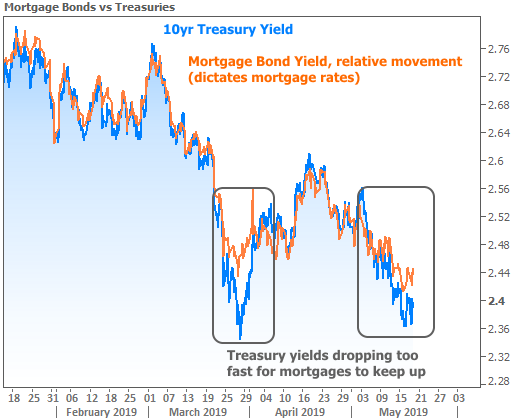

Apart from Home-Equity Lines of Credit (HELOCs), a Fed rate hike has no immediate implication for mortgages or other long-term rates. Mortgages are driven by mortgage-backed-securities (MBS) which have much more in common with longer-term rates like 10yr Treasury Yields. Longer-term rates do their best to move in advance of Fed rate hikes/cuts.

In other words, the Fed can hike “rates” (meaning their own Fed Funds Rate) and “other rates” (like mortgages and 10yr Treasury yields) could actually move lower. This is exactly what tends to happen near the end of an economic cycle, and many market watchers agree we’re getting close.

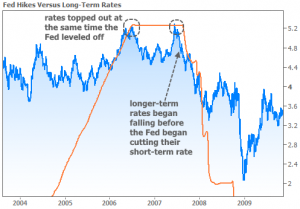

The following series of charts shows how longer-term rates often behave as the Fed gets closer to pausing its rate hike cycle. In all cases, 10yr Treasury yields are used as a benchmark for longer-term rates (blue line). The orange line is the actual Fed Funds Rate.

As you can see in the 3rd case, the Fed had already leveled off BEFORE longer-term rates officially began to fall. Even then, we could still say that longer-term rates began to fall before the Fed began to CUT rates. This is virtually always the case, and will almost certainly be the case in the current cycle.

All of the above begs the question: if we know the Fed is going to hike, and if we know that doesn’t necessarily mean longer-term rates have to move higher, why is next week’s Fed announcement a big flash point?

This is an excellent question. Indeed, a garden variety Fed announcement–even one that results in a rate hike–hasn’t been much to write home about recently. This one is different for the same reason that rate volatility has increased recently. Specifically, the tone from Fed speakers changed markedly in late November and early Dec. This was most apparent in a late Nov speech from Fed Chair Powell in which he said rates were getting close to Neutral (in other words, the end of the Fed’s rate hike cycle is in sight).

Keep in mind that the Fed’s rate hike cycle isn’t based on random decision making among a bunch of stuffy old bankers. They actually have to pay attention to underlying economic realities when it comes to setting policies that promote or dissuade growth.

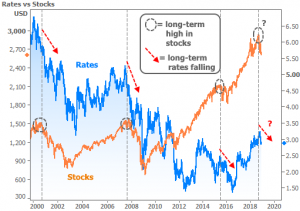

More simply put, the Fed is beholden to the writing on the wall. If economic indicators begin to shift, Fed policy will have to follow. While the Fed doesn’t set policy according to the stock market, stocks nonetheless act as one of those indicators. The following chart shows that rates reliably fall when stocks undergo a large-scale shift (2015’s example was much less pronounced due to the distortions caused by the Fed’s unprecedented asset purchase program, which helped both stocks and bonds).

Bottom line, markets suspect the Fed–either through the text of their policy announcement, the press conference with Powell, or the quarterly update of their rate hike forecasts–may confirm just how serious they are about slowing the pace of rate hikes or doing something else to acknowledge potential shifts in economic realities.

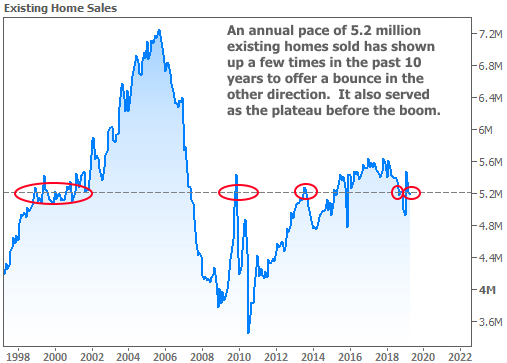

In addition to the Fed, we’ll also get updated reports on several housing market benchmarks (new construction, builder sentiment, and existing home sales). Much of that data collection happened BEFORE the nice drop in rates, so any resilience in the housing data would be doubly reassuring (because the lower rates that followed would only help).

© 2018 MBS Live, Inc. 19701 Bethel Church Rd Suite 103-225 – Cornelius, NC 28031. All rights reserved.